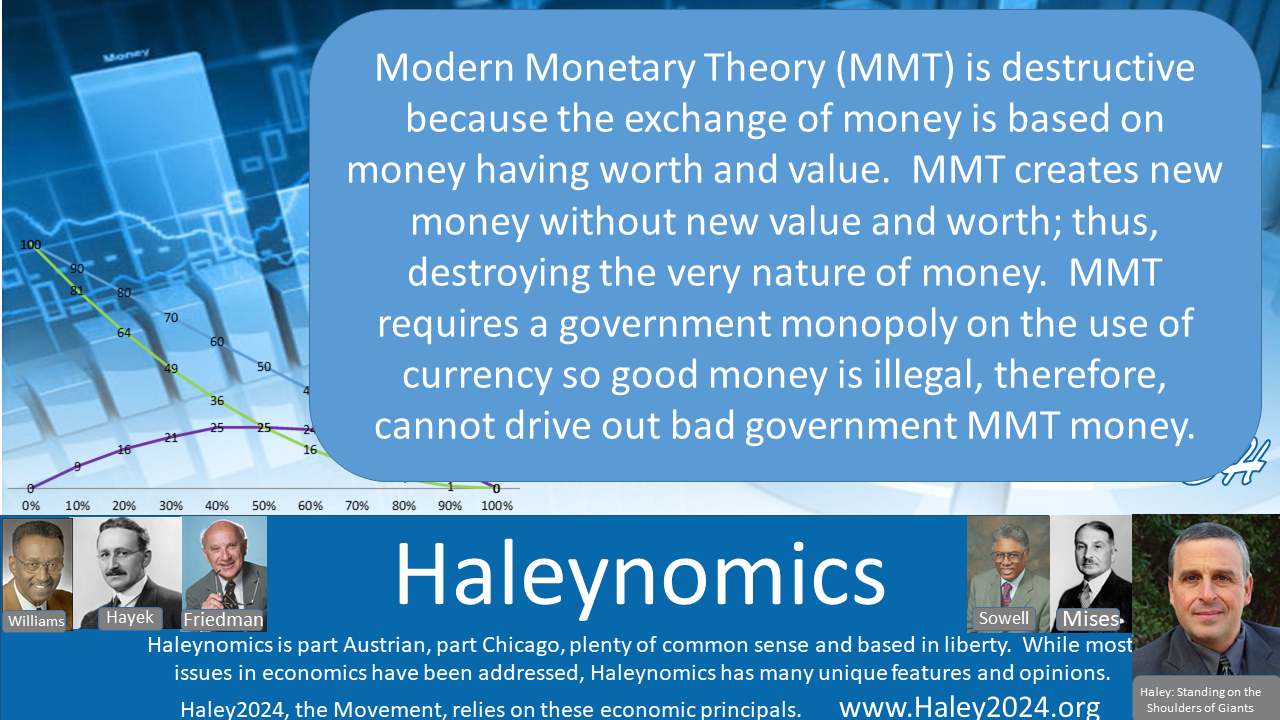

| Modern Monetary Theory misunderstand the nature of money. Modern Monetary Theory is just creating new money without new underlining assets. Money is a store of value. Creating new money without new value undermines the very nature of money. The great Walter William famously teaches that money is proof that you served your fellow man; therefore, you can request services from others. The first money used were actual items of worth that a majority of people actually used. People were paid in salt because salt was used by everyone to preserve food. |

| The overwhelming necessity of money is that it has value and holds that value. The only place new money without new value can attain its value is shaving off value from all existing dollars. Tyrants used to shave a little bit of the gold off gold coins and use that gold for more coins. People started to see the difference and valued those shaved coins less than unshaved coins. |

| Modern Monetary Theory violates that vital necessity of money holding value. Long term contracts must have a stable currency. Savings for retirement or a raining day is beneficial. Thus money losing value is a disincentive to save. Capitalism needs capital and currency losing value reduces the value of capital, thus reducing capital. Warren Mosler stated on several interviews lately that it was okay if taxes bring in $3 trillion and the government spends $4 trillion per year in a $20 trillion GDP economy. |

| That extra $1 trillion takes its value from all the other dollars and will cause the dollar to lose about 5% a year. It is hard to give a 30-year mortgage when the value of the dollars paid in the later years is a small fraction of the current dollar. This $1 trillion money from thin air is a $1 tax or roughly an average of about $9,000 per US household. Of course, there is the added detriment of lower retirement planning and lower capital for businesses. A volatile value of the dollar makes long term business planning more difficult. |