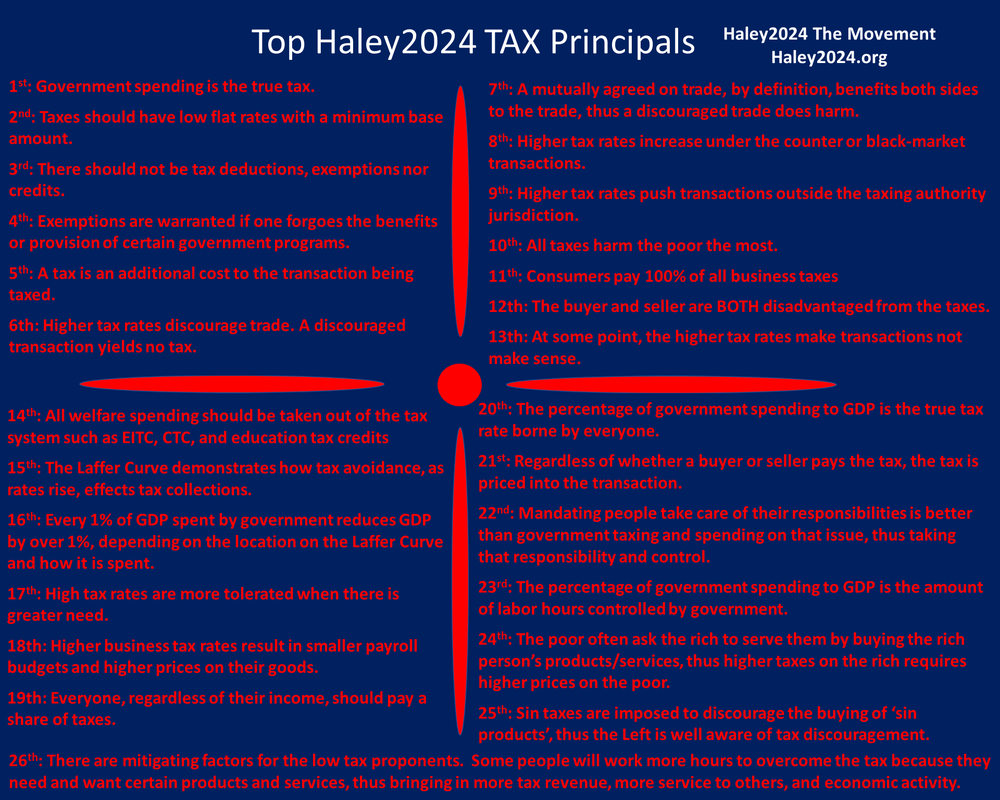

| Above are Haley2024’s top 26 tax principals. Below is an expanded explanation of the principles. Each paragraph with the explanation is beside the QIP with one of the principals. Phones will likely have the Quote in Picture boxes (QIP) above or below the explanation paragraph. Many of the principles and explanations are interconnected, and explanations will likely flow over many principles and paragraphs. Thus there is reliance on many of the other principals to provide further enlightenment on each individual principal. |

| Milton Freidman famously stated this, and it is not often totally understood or appreciated. The level of spending must be collected in taxes, borrowed or monetized. Taxes are addressed below. Money borrowed removes a certain amount of capital from capitalism, by demanding the money from the capital or saving system now. Supply and demand demonstrate government borrowing results in higher interest rates, which is a ‘tax’ on borrowing. Monetizing the debt or deficit, taxes existing dollars in a very real; however, obscured tax. Blog: Spending as a Tax. |

| The value of low rates will be described numerous times below. A flat rate is by definition the best way to have the lowest rates. To receive the same tax revenue, non-flat rates would have to have some people paying rates higher than the flat rate and some paying lower rates. The minimum base amount is described below; however, is a powerful tool to keep the flat rate lower than without a base. |

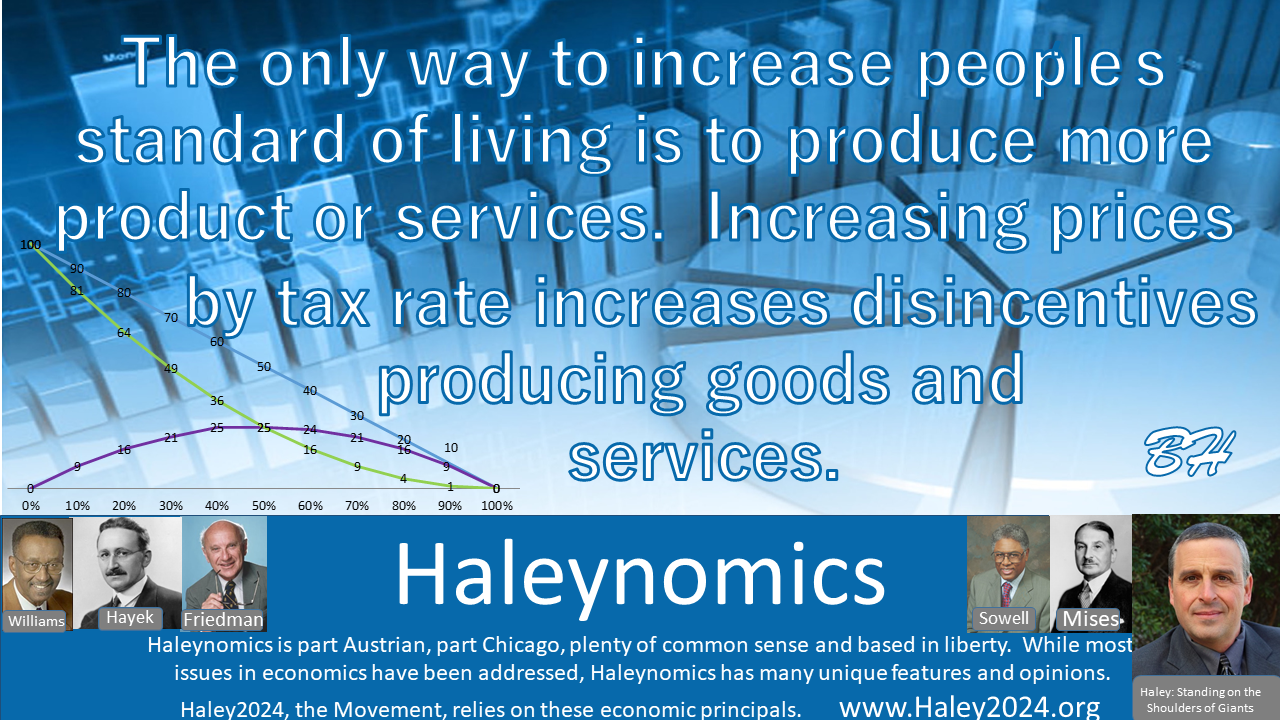

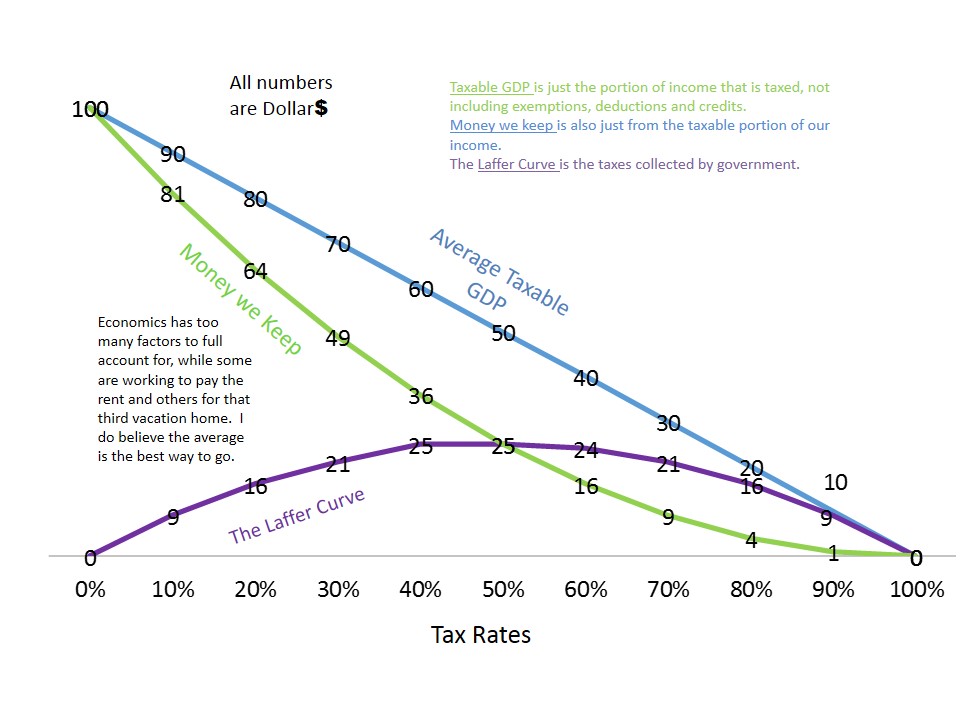

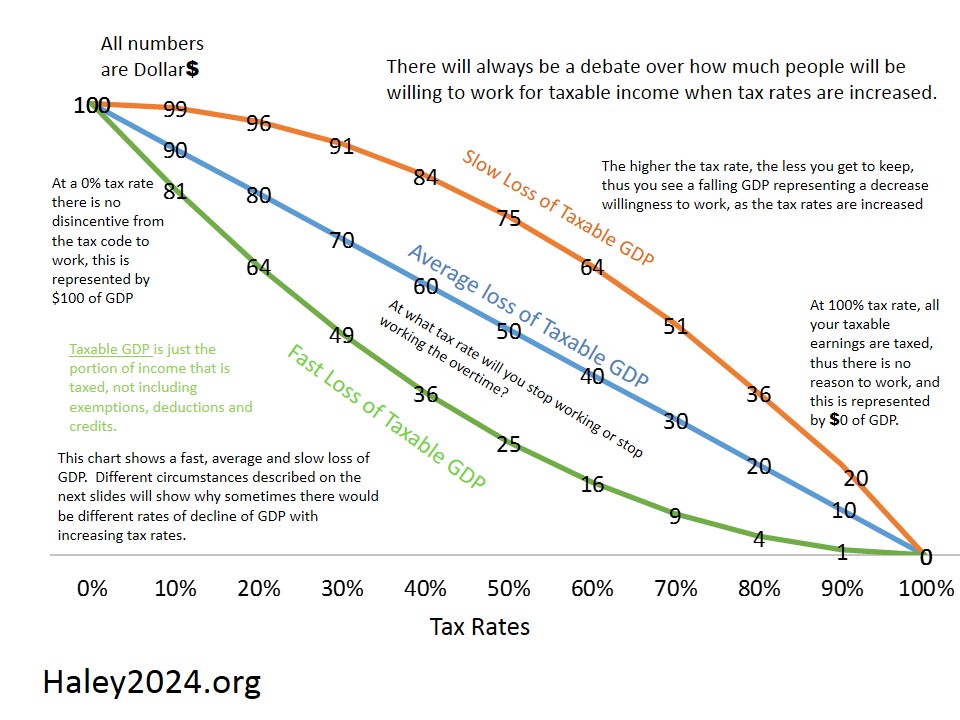

| Many people love tax deductions, exemptions, and credits. Most people do not understand that these push rates up. If the government needed $20 out of $100 economy, the tax rate would be 20%. If the government exempts 50% of the income, the rates would seem to need to jump to 40%. The Laffer Curve effects would curtail the taxable portion of the income, causing lower GDP and lower tax collections. The increasing the tax rate, chasing the $20 from the taxable incomes, slides down the bad side of the Laffer Curve. |

| If the government still needs to collect $20 from the transactions, just collect it without playing games of ‘acting like’ you are getting money or a discount. The government could collect 20% of a $100 economy or 50% from an $80 economy with half of it exempted. Blog: Deductions, Exemptions and Credits create a faster loss of economic activity |

| Creating a rule of law or national defense is a joint effort that is difficult to take one's self out of and to handle those efforts individually. However, education is a good example of a government program that one should have the option of being exempted from and handling on their own. One would be exempted from the tax and the benefit of education. The government could still have an interest in ensuring that child education neglect laws are respected. |

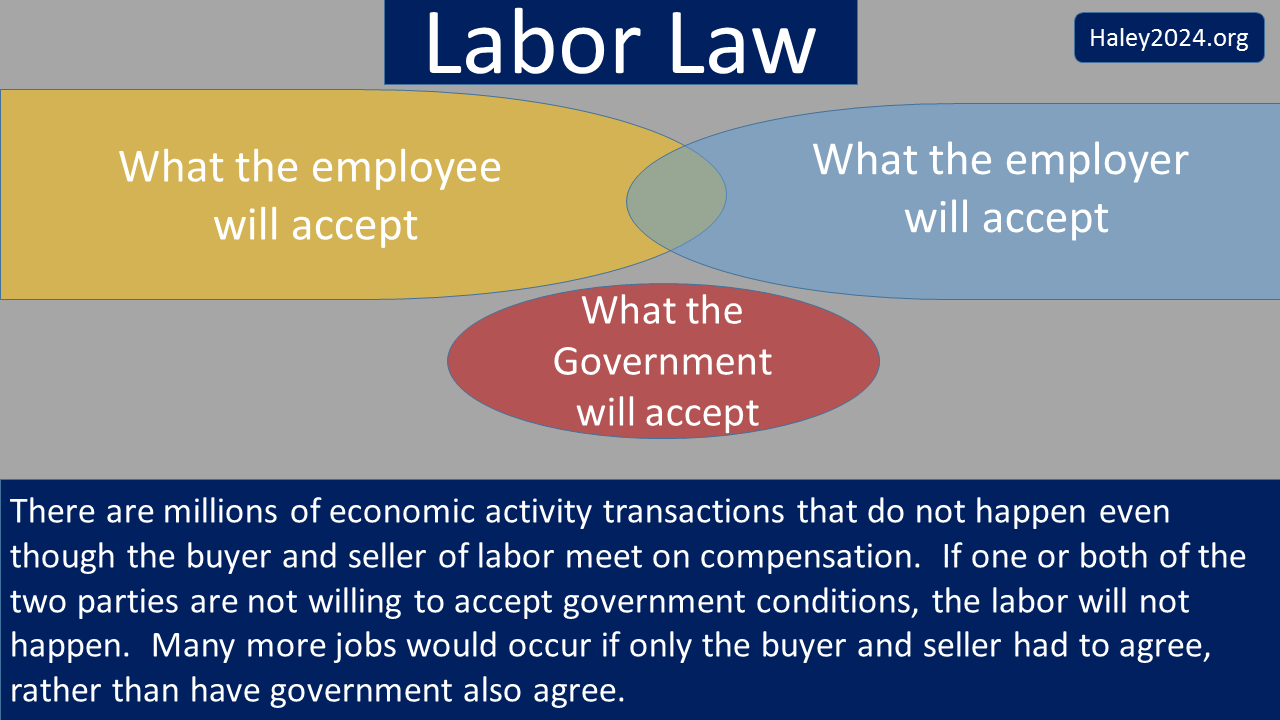

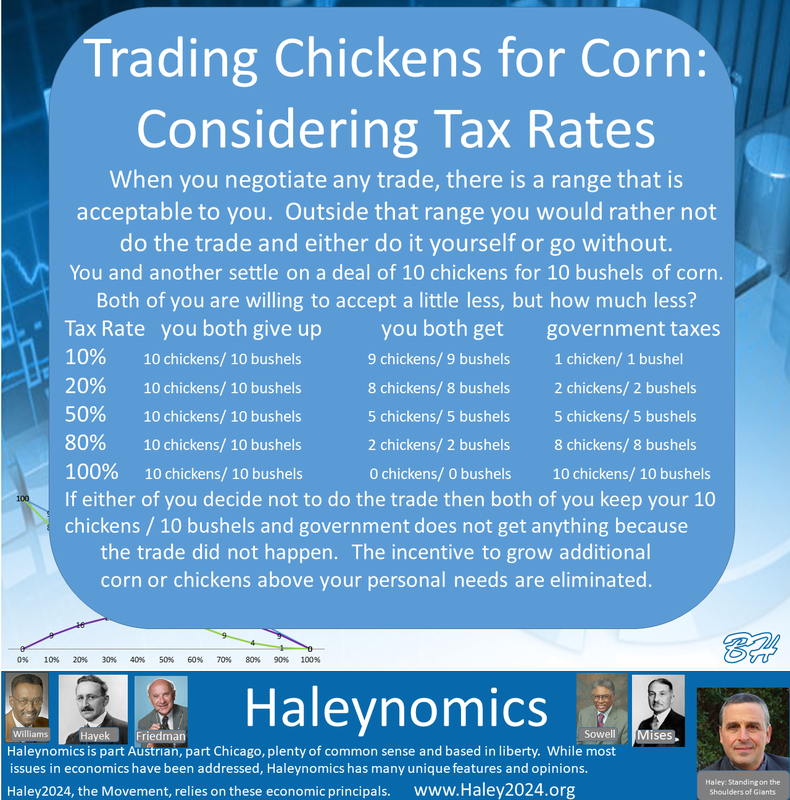

| If a consumer knows that an item is $10 with a 20% sales tax, the consumer clearly makes the decision to buy the item based on having to turn over $12. If a baseball player signs a $10 million contract, he clearly knows he is taking home roughly $5 million. The store only keeps $10, and the team still pays the $10 million. Thus the overlap of agreeable terms must be larger than the tax. |

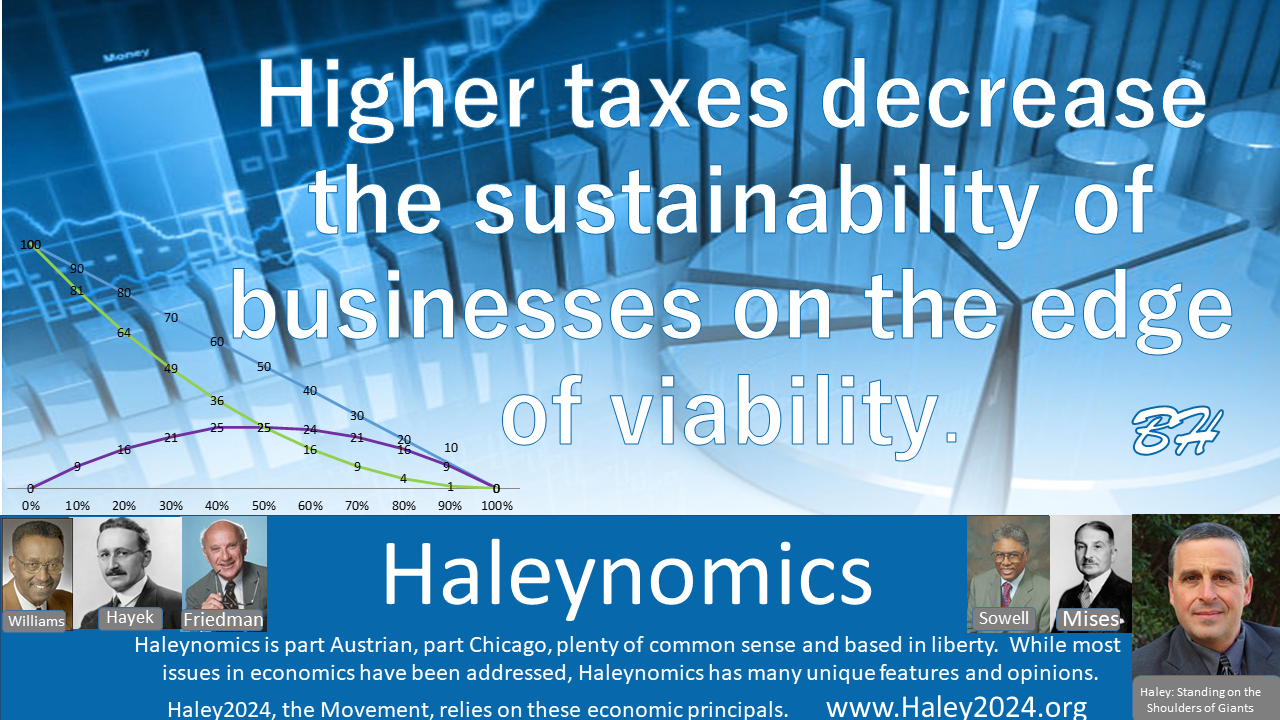

| If a homeowner put out a sign stating that he will pay someone $1 for 10 hours of yard work, he would not have anyone agreeing to those terms. If he offered $1,000 for those 10 hours, he would have a long line of people wanting to make that deal. Every person has their price where the ‘no’ turns to ‘yes.’ If that price is $200 take home with a 33% tax, the homeowner must pay $300, so the laborer receives $200. If the agreeable terms are not overlapping the tax rate, the transaction does not happen, thus yielding no taxes. |

| At some price, the homeowner will either do it himself or leave it undone. If the homeowner sets his upper price at $295, the transaction will not happen. There was a $95 overlap ($200 - $295) between the two parties where each of them decided the transaction would make themselves better off. The 33% tax rate stopped the transaction. When the tax rate goes up, the transactions are curtailed. There is no tax collected from a rejected transaction. Blog: The Poor are Harmed the Most by the Effects of the Laffer Curve |

| Agreements on transactions between two people often come without much overlap. Tax rates often push the two parties out of the agreeable terms. Many people are willing to risk getting in trouble with the law as the benefits of avoiding the tax increases. Not many will risk penalties of the law for a 5% to 10% tax; however, as rates become oppressive many will take that risk. Under the counter transactions yield no tax. |

| People from many socialist states rely on the black market to survive and increase their standard of living. Many people around the globe risk harsh consequences to overcome the oppression of socialism. The more socialistic a country is, the greater the likelihood they will force their ‘citizens’ to stay in the country. Haley2024’s Pockets of Freedom could help save billions of oppressed people. |

| There are thousands of examples of higher tax rates having the effect of changing the geographic location of the transaction. Higher cigarette taxes mean people are stocking up across the border. High yacht taxes under Clinton resulted in the rich buying, building, servicing, and docking yachts overseas. |

| Global businesses use tax inversion to base their business in a lower business taxed country. Online businesses often decide what state to base their business in, based on state taxes. Military personnel regularly claim residence in a low-income tax state regardless of where they are stationed. States advertise their job friendly taxes when lobbying for businesses to relocate in their state. |

| The blog named, ‘all taxes harm the poor the most,’ goes into detail on how higher tax rates discourage business creation. It further instructs on how supply and demand for jobs pushes wages up when there are more businesses and consequently pushes wages down when many businesses no longer make sense. This blog also goes into higher taxes pushing economic activity in the black market or out of the taxing jurisdiction. |

| There is a big debate about whether a sales tax or an income tax is a better idea. People claim it is unfair that either the buyer should pay or the seller should pay the tax. In the end, the tax is on the transaction between the buyer and seller. The tax is built into the price or in the case of a sales tax; the buyer makes the decision based on the full price which includes the tax. |

| If one saw a product that they wanted, the price would factor into the decision to buy. If the product was at their upper price limit, a sales tax could push it out of their buying price range. Likewise, if one were offered an extra side job, the price would be a factor in whether they took the job. If one’s bottom line was taking home $50 for five hours of work; a 20% tax on a $60 offer would yield the service undone, the income not made and $0 of tax collections. |

| Tax credits push up tax rates much faster compared to tax deductions. Tax credits are very similar to government spending. Let’s say the country has a $100x economy and needs to collect $30x for government spending. If the tax code allowed $10x in tax credits, the people paying taxes would need to pay $40x worth of taxes ($30x plus $10X). 40% tax rates create a higher disincentive than 30% tax rates. A greater disincentive yields less taxable activity, thus a lower tax base. Tax rates increases would need to chase the $40X as the tax base drops. |

| A 50% tax rate would drop taxable GDP by about 30% compared to a 30% tax rate. Thus tax revenue does not even approach the needed $40x, and the poor have far fewer opportunities with 30% lower business activity. The Haley2024 Charity System is a far better way of helping the poor. |

| There are four main tax avoidance measures. First and second, people can do without the product or service or create the product or do the service themselves. Third and fourth, people can do transactions under the table or they can do the transaction outside the taxing authority. As taxes rise, all four of these measures go up and taxable activity goes down. At 100% tax rates all taxable activity stops. |

| If you traded 10 chickens for 10 bushels of corn and government stated the tax would be that they would take all 10 chickens and all 10 bushels, it becomes unlikely you will make that trade. Without the trade, at least you keep your chickens, and the other guy keeps his corn. Some people will withstand 10%, others 30%, and still others even 60% tax rates. Everyone will have their tax rate threshold in which they will stop trading. Once one of the two parties reach their threshold, the trade ends for both parties. When there is still agreement, both sides are benefited, and the government receives some tax revenue; however, once the tax rate threshold is hit, both parties are not benefitted, and the government loses the tax revenue. |

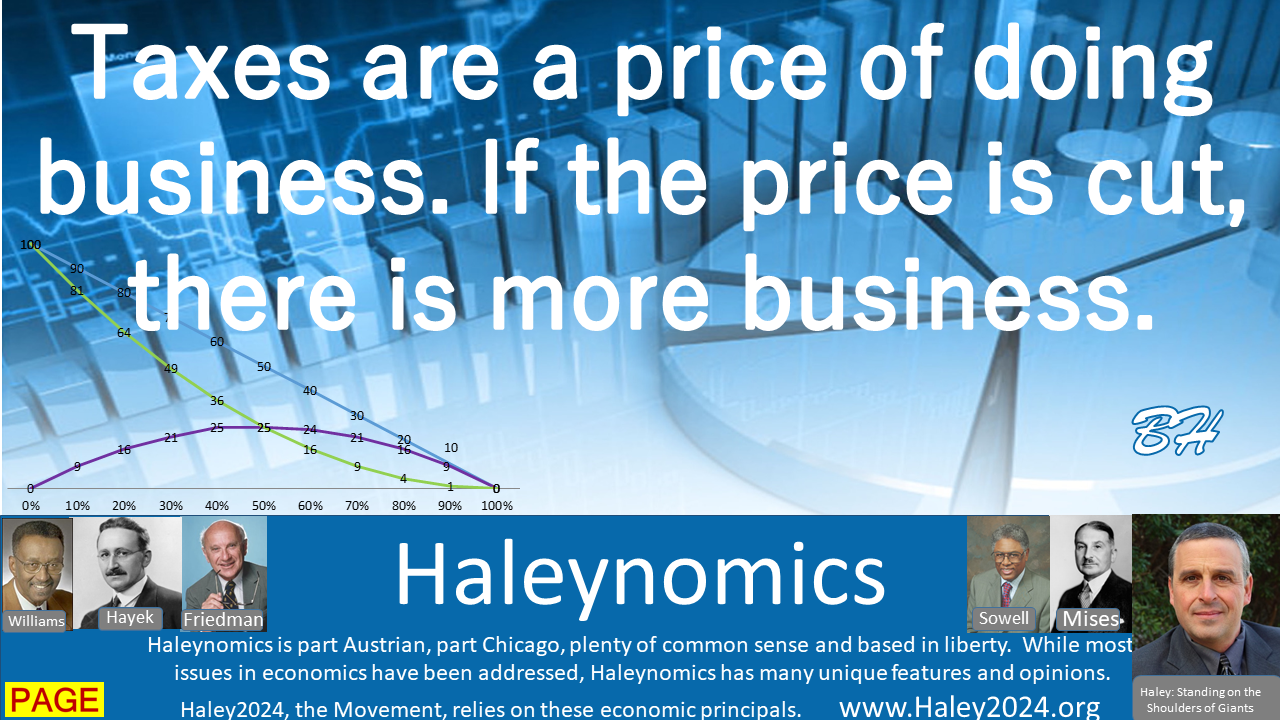

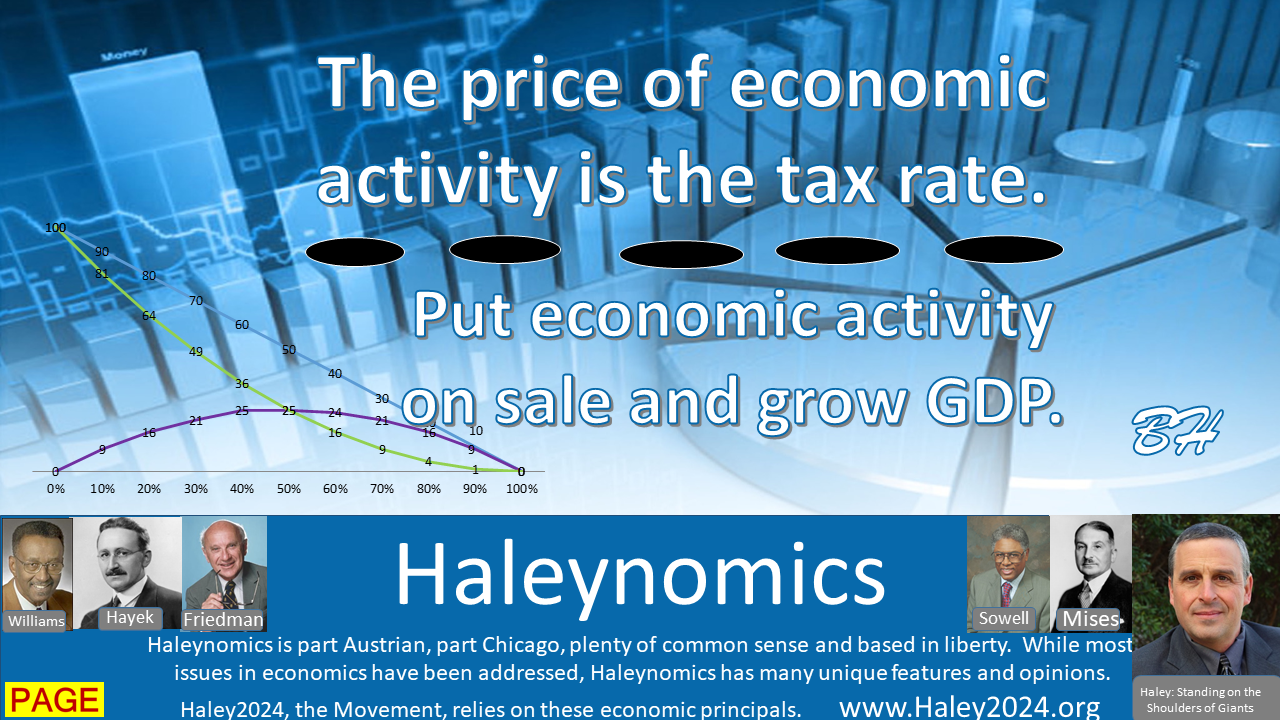

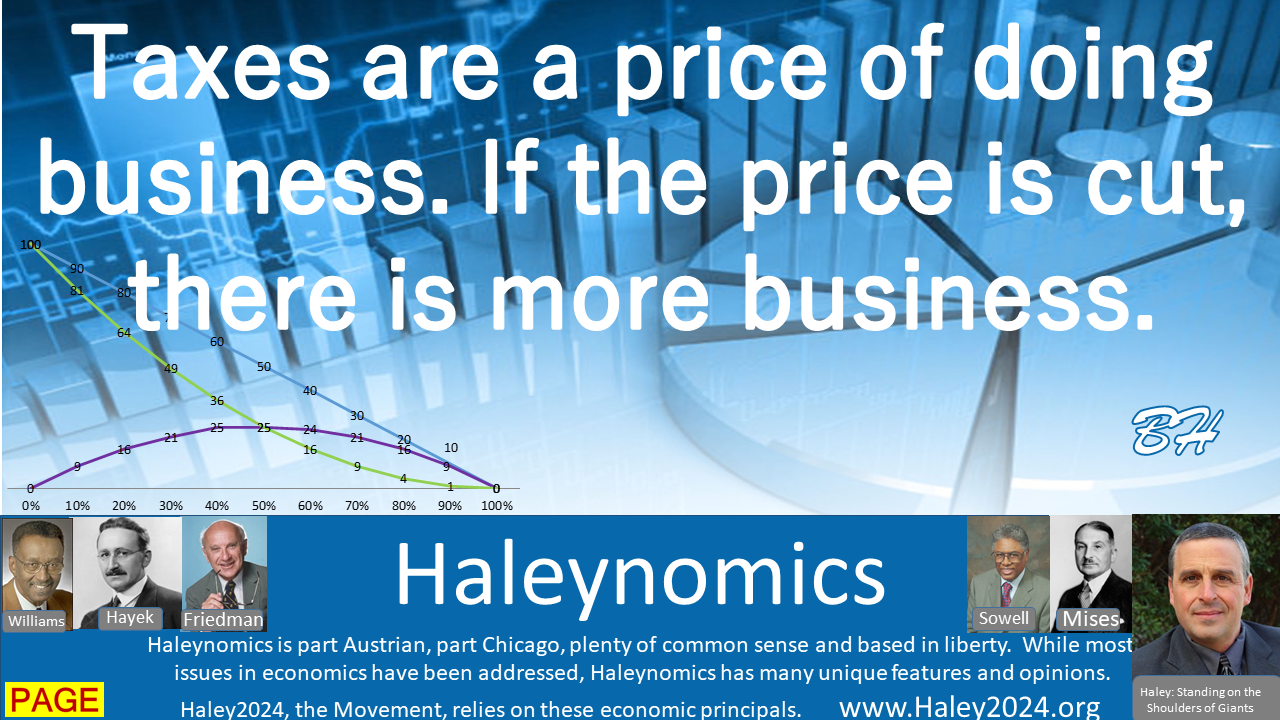

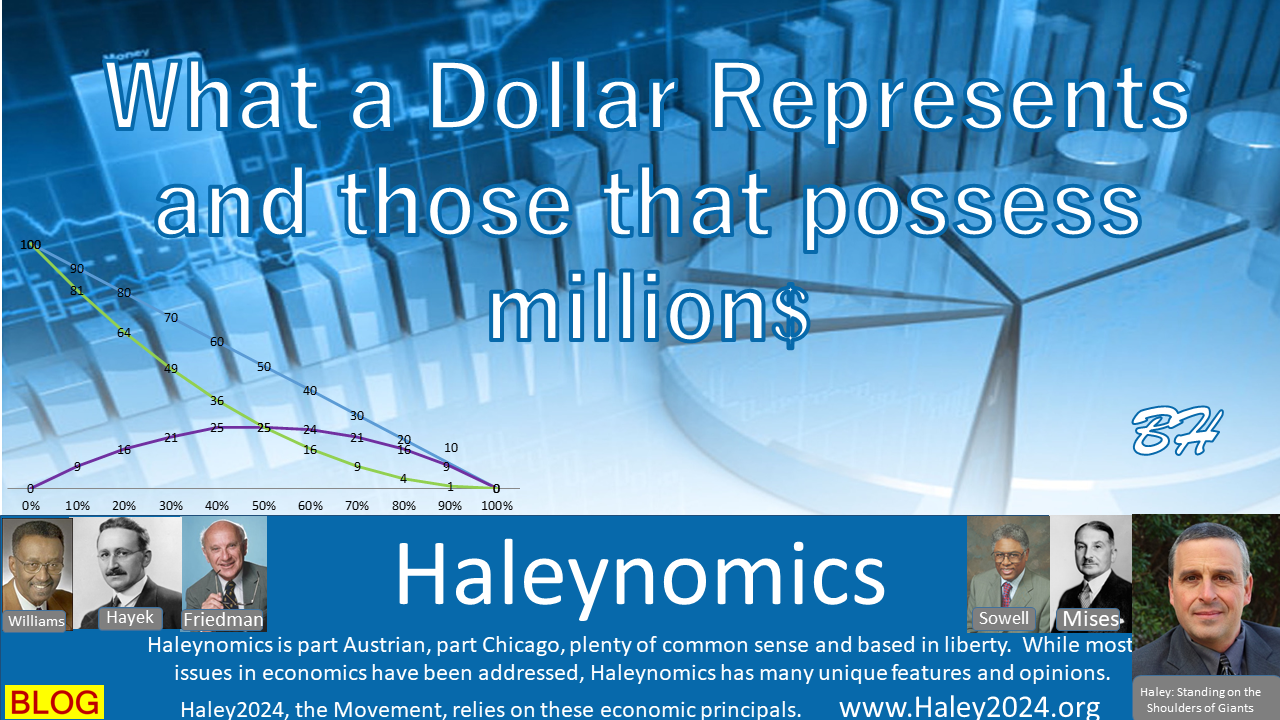

| Let us start at a 10% tax rate because there is no free economic activity if our country is taken over by outside forces. Likewise, economic activity and liberty are threatened without the rule of law. On the Laffer Curve chart, a 10% tax rate yields a $90x economy or GDP. At a 100% tax rate, people will not trade because 100% of both sides of the trade are taken from you and the other party. |

| Whether the Laffer Curve assumes a fast drop of GDP or a slow drop of GDP, the Laffer Curve always arrives at $0X of GDP. By definition, the line needs to slope down, and by definition, it has to average $1X of GDP for every 1% increase in the tax rate or more importantly the percentage of government spending compared to the GDP. However much the Left likes to disagree with the Laffer Curve, the facts and logic of the Laffer Curve are overwhelming. |

| In the blog, ‘Why People Don't Work all 168 Hours a Week’, it is explained that if needs are not met, people are more willing to work with higher tax rates because not eating nor having shelter is miserable. However, if the extra hours at work is just to pay for pool cleaning at one’s third vacation home, many would rather be off work to be with the family. When one’s needs and desires are met, unless one really enjoys their work, even low tax rates could discourage more labor hours. |

| The blog, ‘Corporate Tax Cuts’, gives an expanded account of business taxes. Too often, people argue about who will get the money from the tax break. A tax reduction is simply a reduction in the cost of doing business just like reducing any business expense. Every business expense line item demands consideration of those funds including consumers demand for lower prices. The level of each will result from billions of decisions from millions of people. |

| When citizens contribute, they feel more included in society. When citizens contribute, they care more about how the government spends the money they earned. When citizens contribute, they wonder if they could use their money better to take care of the problem in the free enterprise system. When all citizens contribute, lower tax rates are required. Hidden taxes built into the prices of products do not yield as many of these benefits. |

| Economics is complicated, and many factors could be argued; however, taxes on the most part come from economic transactions. If Government is demanding roughly 38% of labor hours by spending 38% of GDP, it stands to reason that transactions, recognized as part of GDP, are taxed by the government at 38%. |

| There is the full realization of the mitigating factors such as personal property taxes are not from transactions. There is full realization that Social Security is more like a forced retirement plan versus a tax and spending on government services. The factors are numerous; however, there is profound truth to the fact that if the government spends 38% of GDP, they first have to take it. |

| Economics is very complicated because the number of factors and the wide division of labor. Supply chains are multi-dimensional. The story of I-pencil shows how many people are involved in creating a pencil in a large free enterprise system. People throughout the supply chain pays taxes at every stage. Every time labor is paid, items are shipped, services are rendered, capital goods bought, among others; there are taxed transactions. |

| Regardless of the type of tax, the parties on both sides of the transactions must decide to do the transaction based on what they have to give up and what they receive. The government takes or taxes part of that transaction. If the income tax rate is 10% and If you sell 10 chickens for $100, you give up 10 chickens, however, get $90, and the government gets $10. |

| Haley2024’s main thrust is trading government’s taxing and providing in a certain sector of the economy to government mandating that individuals take their responsibility in that sector. Both mandates get the job done; however, mandating people take their responsibilities in all these sectors, yields better results. Check out the blog on this issue and explore every reform in the top drop-down menus. There Are Four Ways To Pay For Government Services |

| In the blog, ‘Who Should Control the Demand for Labor Hours?’ These ideas are given the additional examination. Regulations are clarified as well as control. It is discussed how some controls in government spending and regulations are minor and others significant. The blog also explores who and why certain people in the free enterprise system get to control labor hours. This tax principle is correct. However, there are significant discussion and nuanced needed in every sector of the economy. |

| Business owners are on average, richer than employees. There are many exceptions to this rule; however, the larger the business, the fewer exceptions there are, and there is a greater degree of differences in income. These successful business owners have proven to use the best division of labor and business practices compared to their competitors to serve the most people with products and services in exchange for the least amount of money. |

| The poor, as well as other income groups, look to be served at the lowest price, so on average, steer most of their purchases to the rich. Walmart and other discount stores catering to the poor, serve the poor the best as defined by the poor’s shopping decisions. When the rich pay higher taxes, the only place for that money to come from is from people buying products and services, thus the tax is built into the price the poor pay when buying from the rich. |

| The political Left has a conflict with sin taxes. The Left knows that the tax falls heavily on the poor and undereducated. The Left also is very paternalistic and will restrict liberty on the Left’s perception of what is good or bad. The Left wants to dissuade gambling, drinking, junk food, smoking, driving, among other ‘bad for you’ items, by making it more expensive. They do that with regulations and targeted sin taxes on those activities. |

| The Left is very aware that higher prices yield fewer transactions, yet conveniently overlook that fact when talking about regular tax policy. Taxes discourage the buying of alcohol, tobacco, income, large homes, retail sales, investments, businesses and anything else. Taxes do not discriminate against morally good nor bad transactions. Taxes discourage ALL transactions that are taxed. |

| A good economist does not use political ideology to instruct economic thoughts. Economics is morally, politically, and ideology neutral. Political theorists use good, yet neutral economic ideas to create moral and just political ideology. As an economist, one has to be aware of legitimate arguments on both sides; however, good and neutral economics overwhelming points towards lower tax rates creating higher standards of living, greater liberty, higher prosperity, and less animosity for people from every income bracket. |

| If you sell your labor to an employer for $20 an hour, you should realize that the employer must put $25-$30 per hour into the payroll budget and you get the net pay of about $15 an hour. In the negotiations to sell your labor, the employer is putting $27 an hour on the table and asking the employee if he will accept $15 in the actual paycheck. In this example, the government will be taking $12 per hour in federal, state, unemployment, Medicare and Social Security taxes. Some of this $12 is for government-mandated benefits. |

| People understand taxes they pay; however, most people do not fully appreciate how much tax is built into the price of goods and services they buy or sell. The only place taxes can come from is economic transactions. Personal property and real-estate could be an exception. If the seller had to pay a tax, it is in there. If the buyer had to pay a tax, such as sales tax, it is in there. |

| In conclusion, Haley2024 relies on the understanding that if the government provides, it first has to take. This tax page explains why taking or taxing does profound harm. With this understanding, Haley2024 explores ways that the free enterprise system can and should take over most responsibilities currently being taxed and funded by the government. There are many other good reasons for the changes as well as explained within Haley2024 the Movement. |