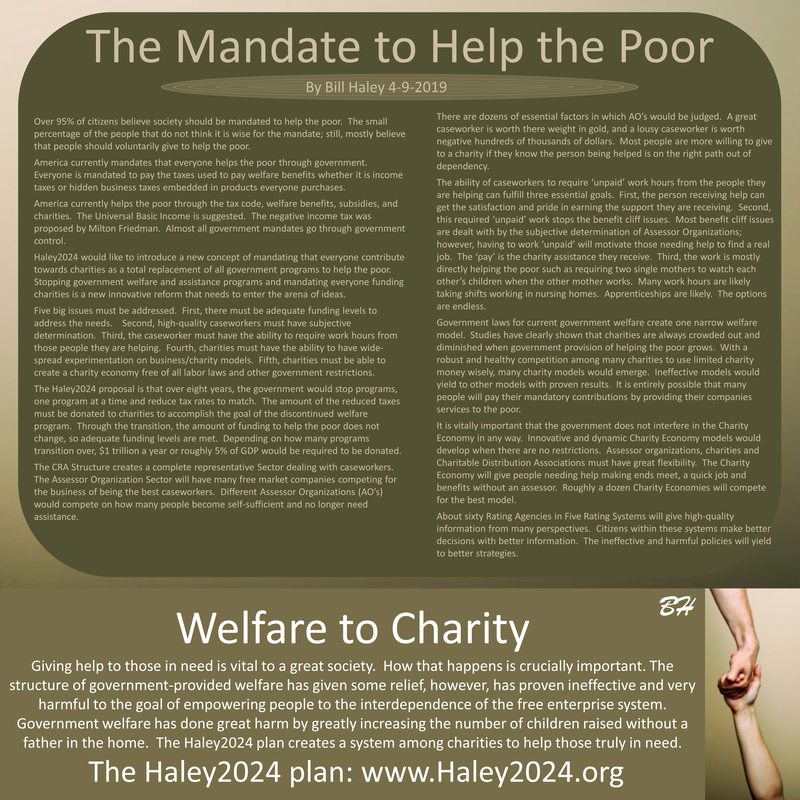

| On March 22nd, 2020, the world is going through the Coronavirus scare. Most people think that this is a time for the government to step up. In fact, the most significant steps are being taken by the private sector. While the government is and should be stepping up, the current government structure is inhibiting many innovative business/healthcare/charity/employment/financial/education/other models. |

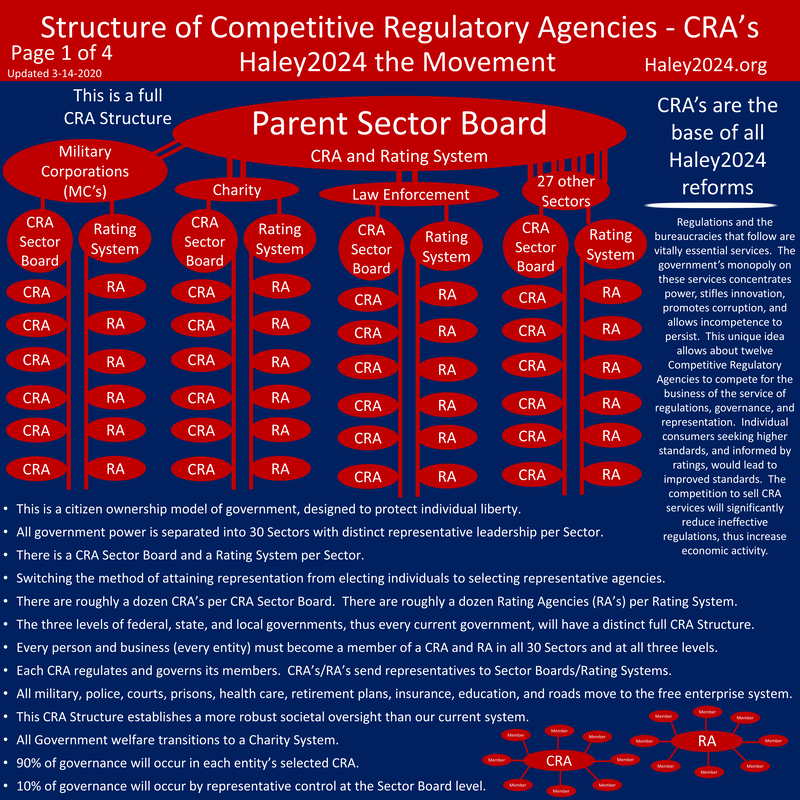

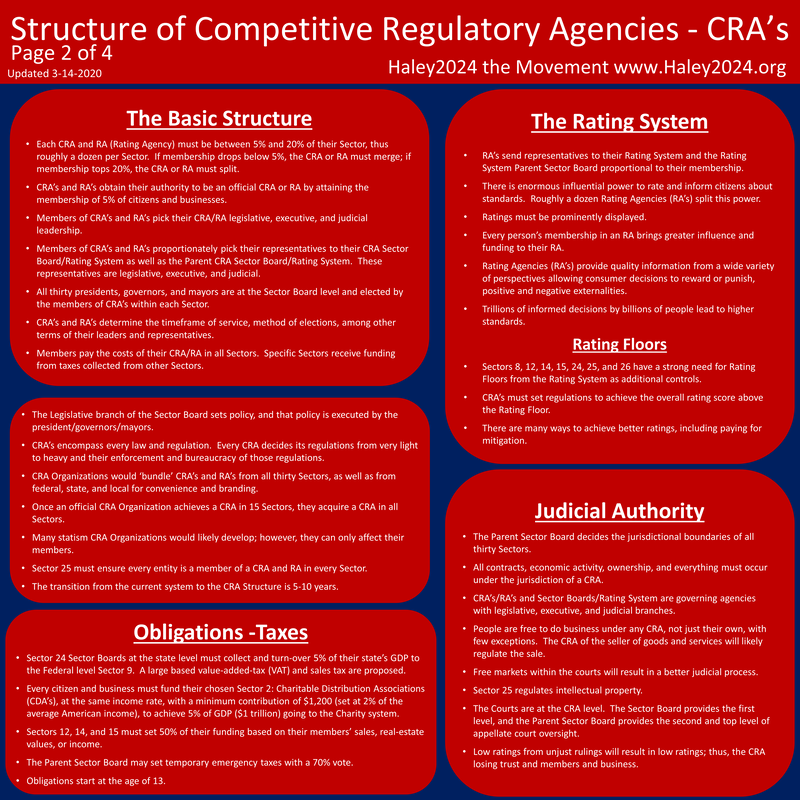

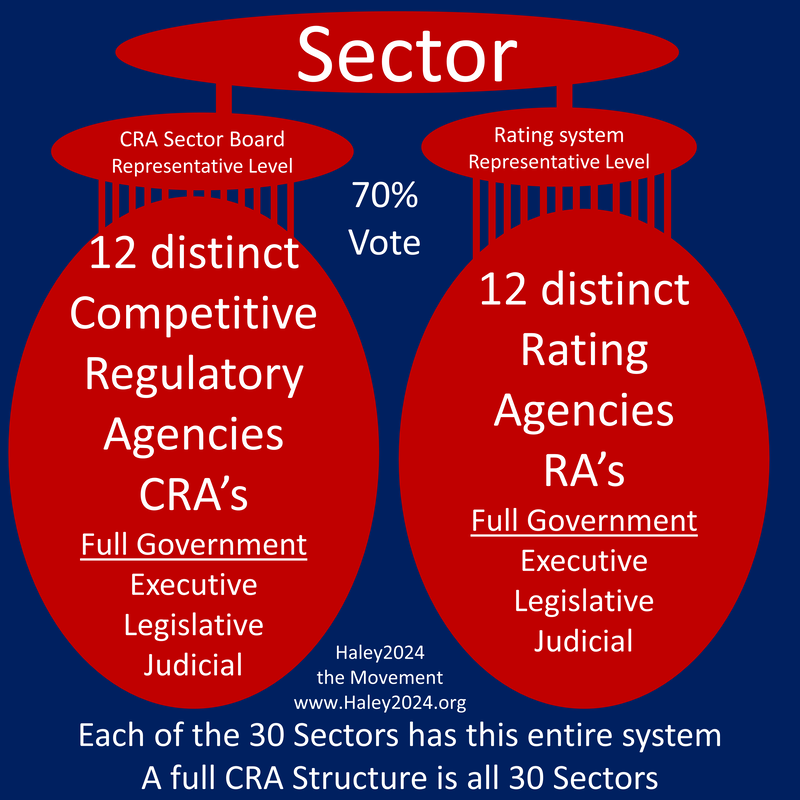

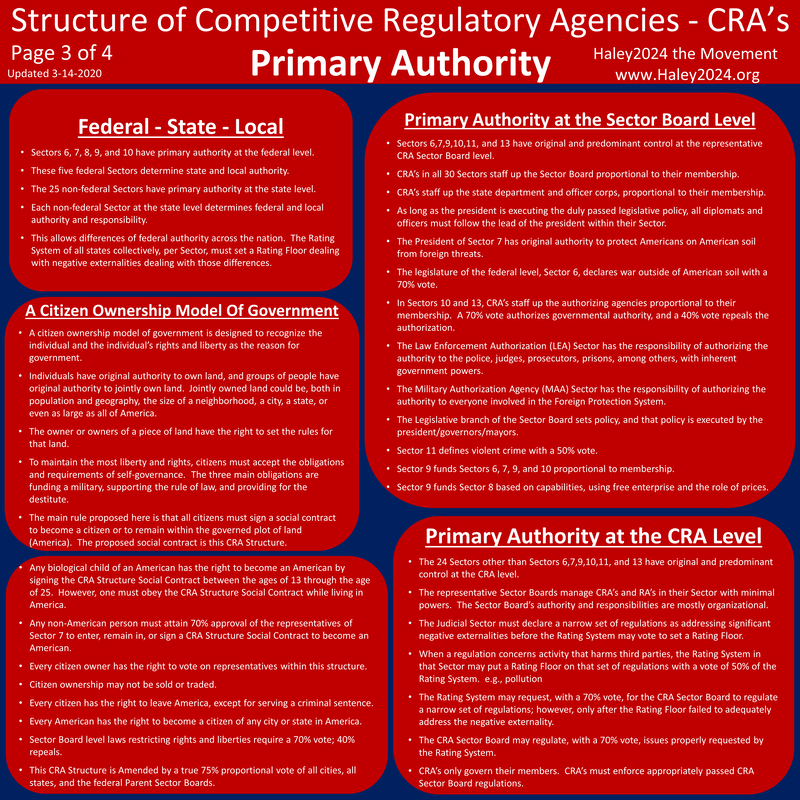

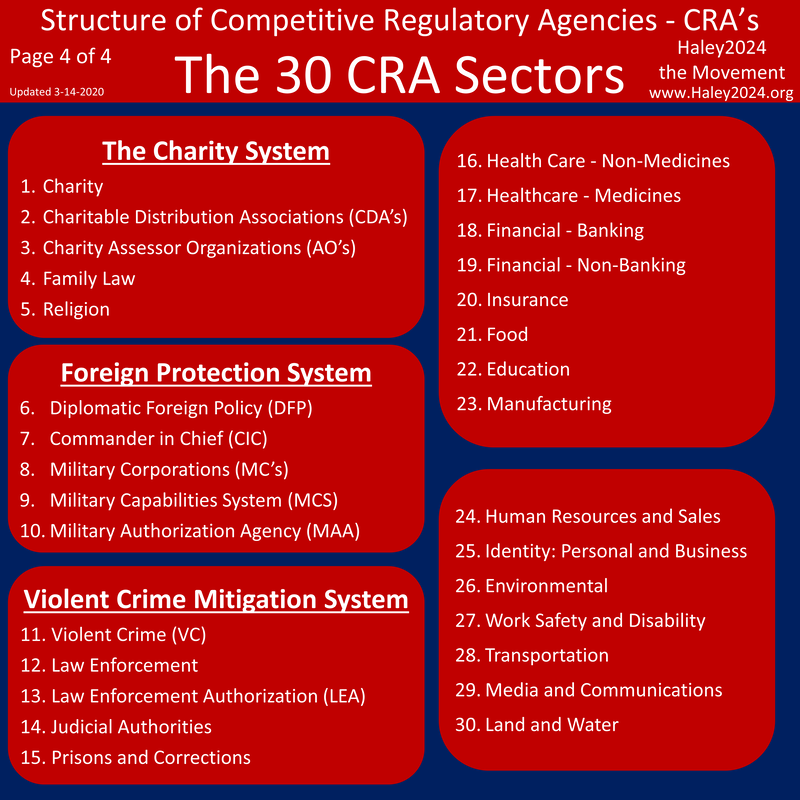

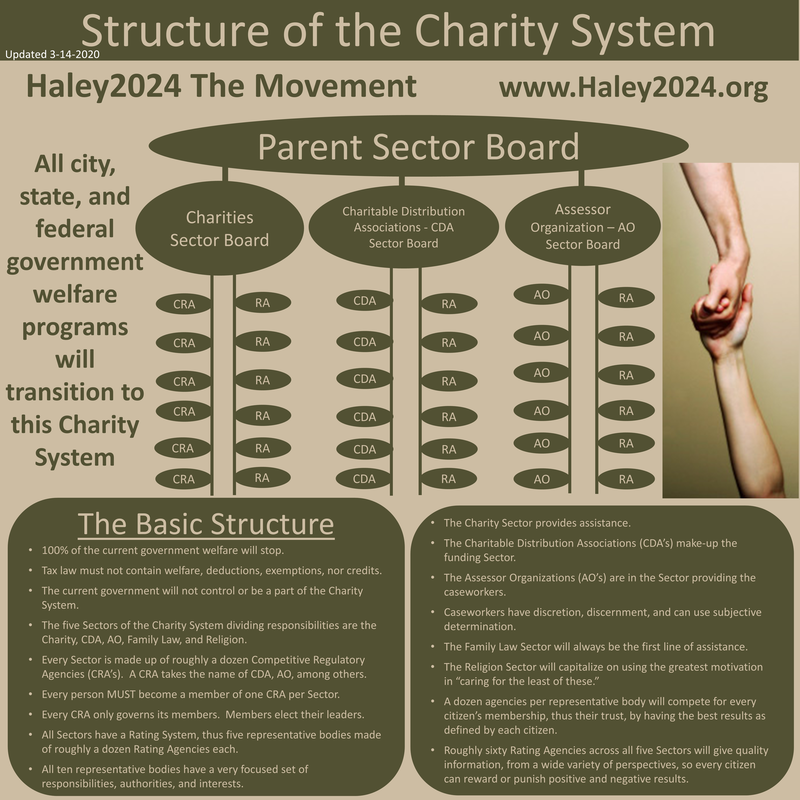

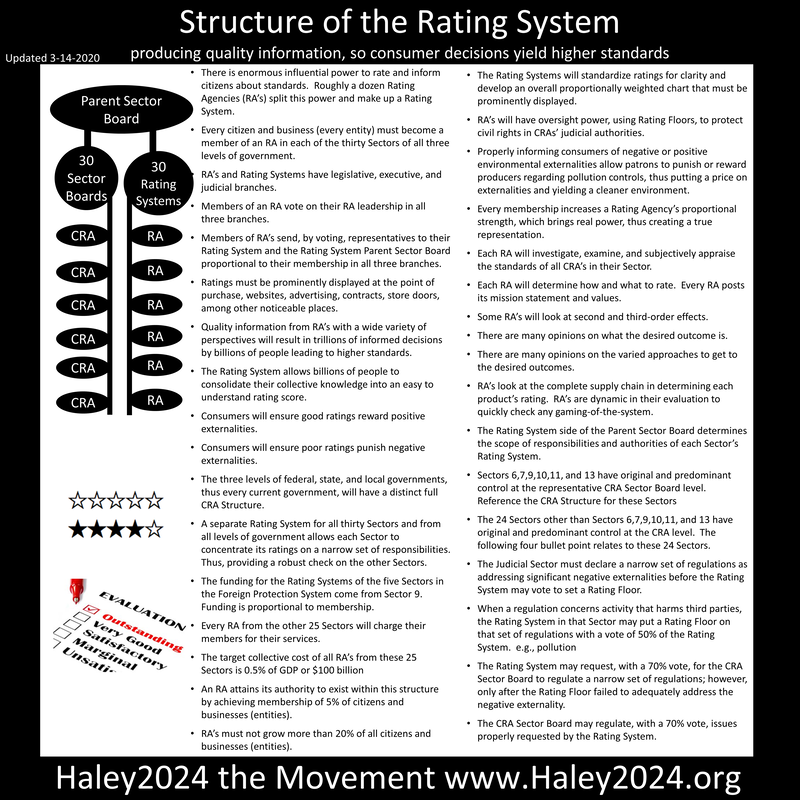

| The CRA Structure allows a competition of governance, competing to become the best at creating solutions to substantial problems. This CRA Structure also allows a representative body with executive power to handle some things that need to be done across the board. Separating all governmental authorities into thirty Sectors allow top elected leaders to have 100% focus on just their Sector. |

| Every Charity Economy, CRA and CRA organization would have a competition for the best planning, and implementation of everything listed below and much more. The Rating System will rate and inform from a wide variety of perspectives. Rating Floors could be raised in certain areas. Both Health Care Sectors will have Sector Boards, which will have the authority with a 70% vote to govern over all CRA’s within the Sector only after trying Rating Floors. |

| While the current president and governors are taking down some barriers to solutions, most obstacles remain. Current labor laws make it hard to repurpose labor. Licensing requirements inhibit a rapid increase in supply. A lot of information and misinformation is out there, and people have a hard time trusting news sources. We do not have the organizations needed to deal with spikes in demand. |

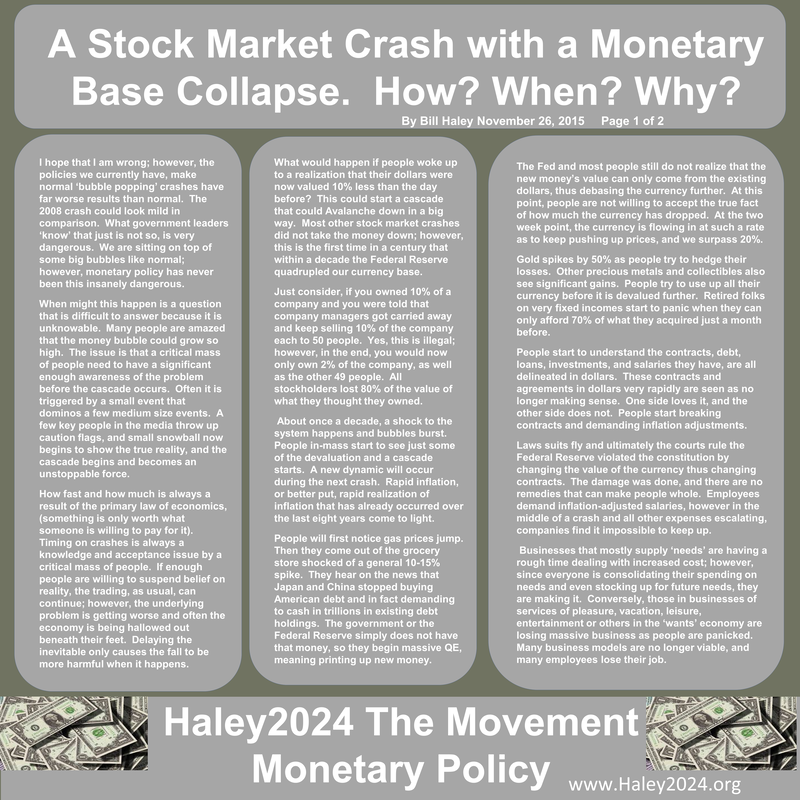

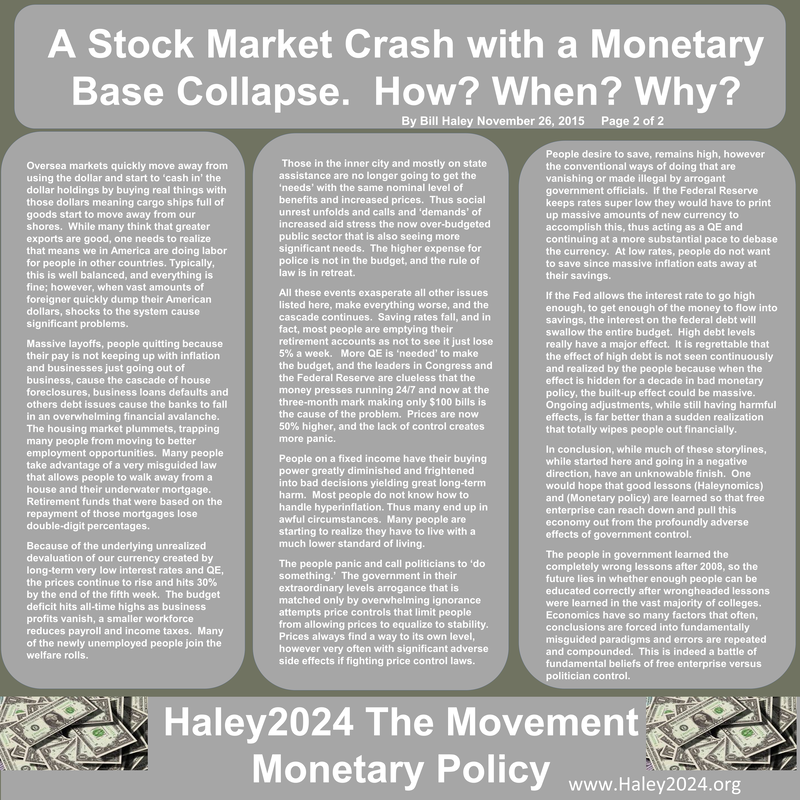

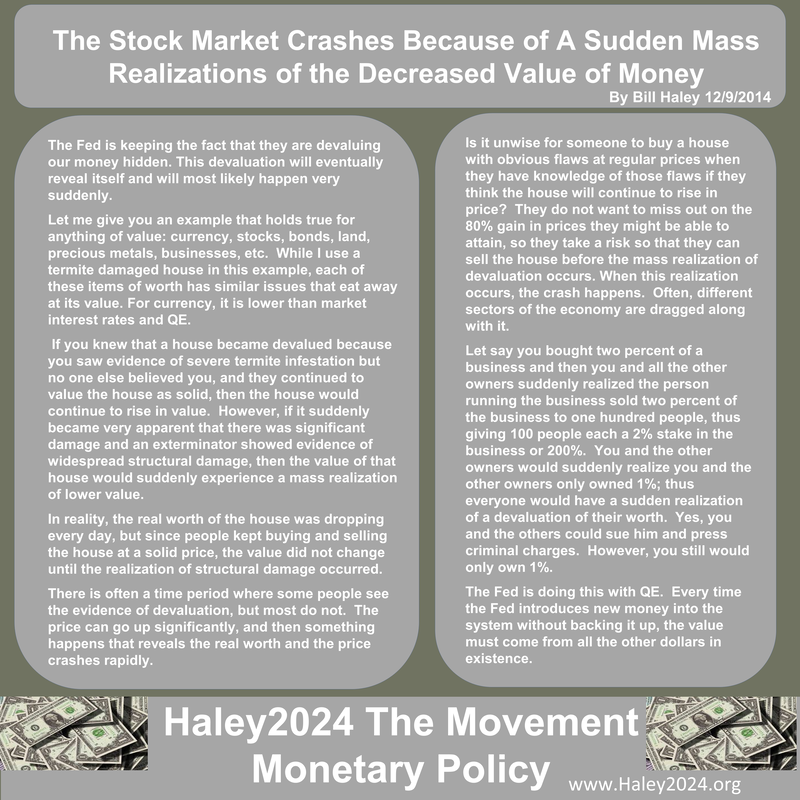

| The current government is looking at sending thousands of dollars to every American. This is wildly irresponsible. With tens of millions of people having their hours cut or totally losing their jobs, production is way down. Our capital stock is taking a big hit. When the government borrows trillions of dollars from capital stocks, for mostly consumption, our capital stock dwindles even further. |

| Money should always go from the people to the government and never from the government to the people. This obviously excludes people working for government or government buying products and services. It is an economic truth that the government must first take from the people to give to the people. Increased tax rates lower economic activity. The role of prices ensures that everyone pays taxes. All taxes harm the poor the most. |

The Charity Economy

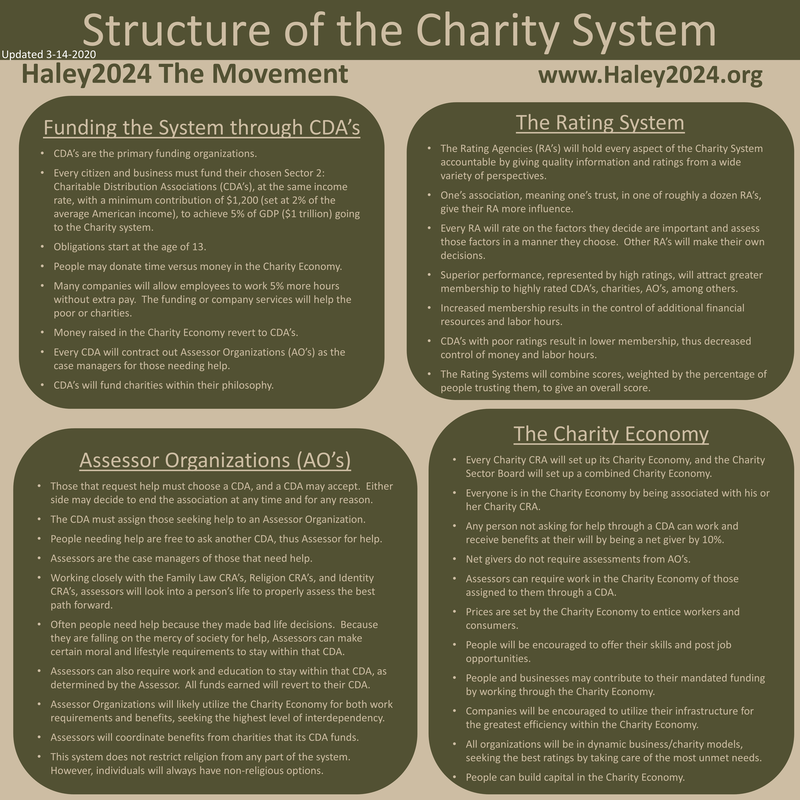

| The Charity Economy will play a significant role in crisis situations. Every person will be a member of a Charity CRA, thus associated with a Charity Economy. They will also be part of the Sector Board Charity Economy. The Charity Economy will have a spreadsheet on all its members’ education, certifications, talents, equipment, and abilities. This includes people and businesses. Non-profit organizations, like clubs, scouts, churches, schools, among others, would be able to list their skills and abilities. |

| In non-crisis times, many people will learn how to be managers. Current managers, teachers, stay at home mothers, and retired folks would be ideal. A proper hierarchy and protocols will be established. These ‘managers’ would be behind their computer screen with every tool and app available. These managers would quickly build teams of adequate size and ability. |

| At the current date in late March 2020, unemployment is spiking. These people and these businesses could be rapidly repurposed for the new temporary economy until the crisis is over, and the normal economy can be reestablished. With roughly a dozen Charity Economies competing to do the best jobs, inadequate protocols will quickly be replaced. The goal of a Charity Economy is to get people back into the regular economy as soon as possible. |

| The current national guard and FEMA addresses some of these concerns. The CRA’s in all Sectors certainly will utilize the talents of the national guard and FEMA. Some of these assets would be in the Military Sector and others in the Police Sector. Many private sector businesses would take over these assets and contract with many of these and other Sectors. The Sector Boards would ensure all areas are covered. |

Teenagers

| One of the great ideas within the CRA Structure is that people need to start taking on their citizen’s responsibilities at the age of 13. They are required to take out law enforcement, court, and prison contracts with a minimum financial obligation. Starting at the age of 13, everyone must contribute roughly 5% of their earnings to charity through a CDA, with a minimum of approximately $1,200 a year. The military is funded by sales taxes. |

| These two more substantial commitments and the requirement to start paying CRA and RA fees would create a minimum of roughly $3,000 per year in obligations. All these obligations could be paid for with labor hours in the Charity Economies, CRA’s, RA’s, directly with companies, among other places. It is likely that the first couple of years in the early teens would be training, on the job preparation, and learning the skills to be productive in the future. |

| A person’s Identity CRA would provide record-keeping on abilities and certifications. There are 10’s of millions of teenagers in America. If they do many courses of training and certifications, all documented in their Identity CRA spreadsheet. These teens could quickly be put on teams to enhance capabilities when big things happen. Imagine if millions of teenage girls could quickly be matched to families needing child-care when the schools shut down. Planning in good times is key. |

The Rating System

| The Rating System would inform. Having a competitive system requires a wide variety of perspectives. The common man would quickly see the majority opinion and those with extreme views. People will see many write-ups on the history of past predictions and every RA’s opinion about those opinions. Every Sector having a complete Rating System will focus every RA to just their expertise. This will create checks and balances. |

The Mandate to Debate

| There is currently a lot of mistrust of information. People do not want to trust the politicians from the other party. There is a lot of reasons for suspicion from all party-affiliated politicians or pundits. Experts with degrees and fancy titles wildly disagree on many issues. It would be beneficial if the top 1,000 experts from a wide variety of disciplines and experiences determined the top 10 or 20 questions and have debates online. These top 1,000 experts would come proportionally from each Rating Agency. |

| One of the mandates of an official RA is the mandate to debate the other RA’s. Misinformation surrounds all events. RA’s would employ experts in their Sector. Science is often very debatable. The interpretation and the full context of science are profoundly unsettled. These experts, to some degree, would post questions. The 1,000 experts would narrow the issues down with votes and debates. All points would need a score from the other experts. |

| The common man, politicians, and business leaders would quickly see how many experts agree with each issue. There would be people designated to keep things simple with links for greater write-ups. The Media and Communications Sector’s Rating System will have an easy to understand rating on the press. The press and media teams from all RA’s would likely rate on truthfulness, context, fairness, and other relevant factors. |

Taxes

| The Parent Sector Board, with a 70% vote, could establish a temporary tax to fund a specific Sector Board. The Parent Sector Board could require an increase in CRA fees, so the funding stays at the competitive CRA level. The likely first step is a Rating Floor increase on funding every members’ CRA to deal with the issue. |

| In a pandemic situation, the Health Care Sectors would need quick funding. All members mandated to fund their CRA an additional $100 could bring $30 billion quickly. CRA’s that keep that type of assets in reserve would likely be rated high. The Parent Sector Board could temporarily increase the mandated charity contribution percentage and minimum. |

Monetary and Fiscal Policy

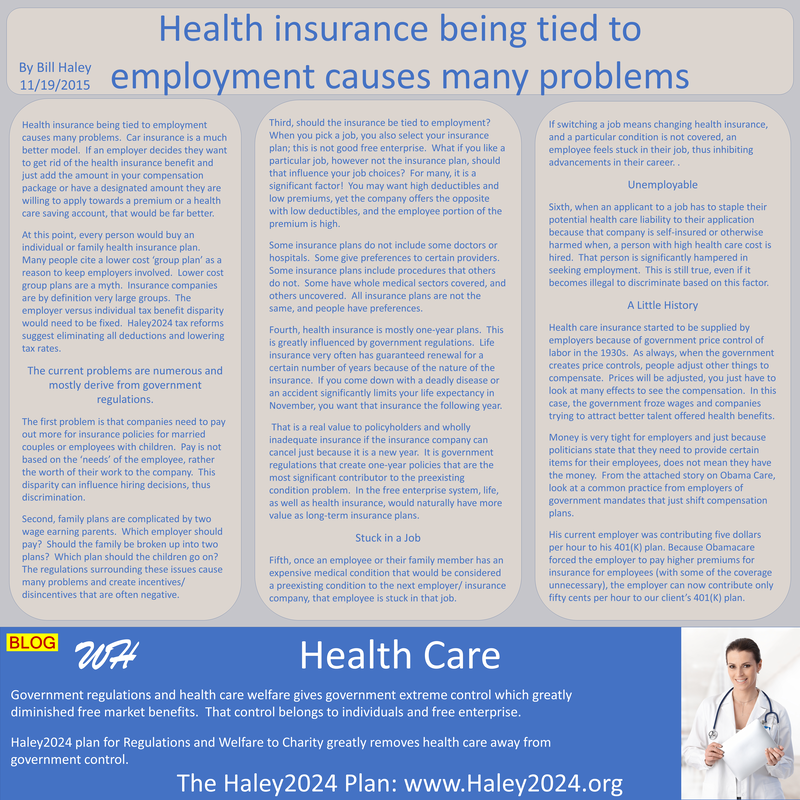

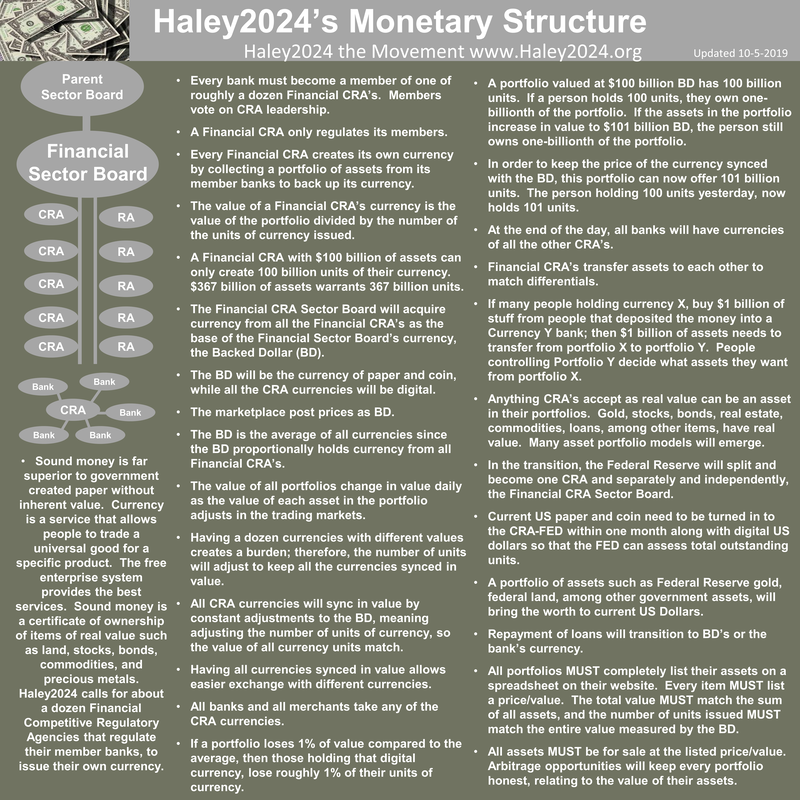

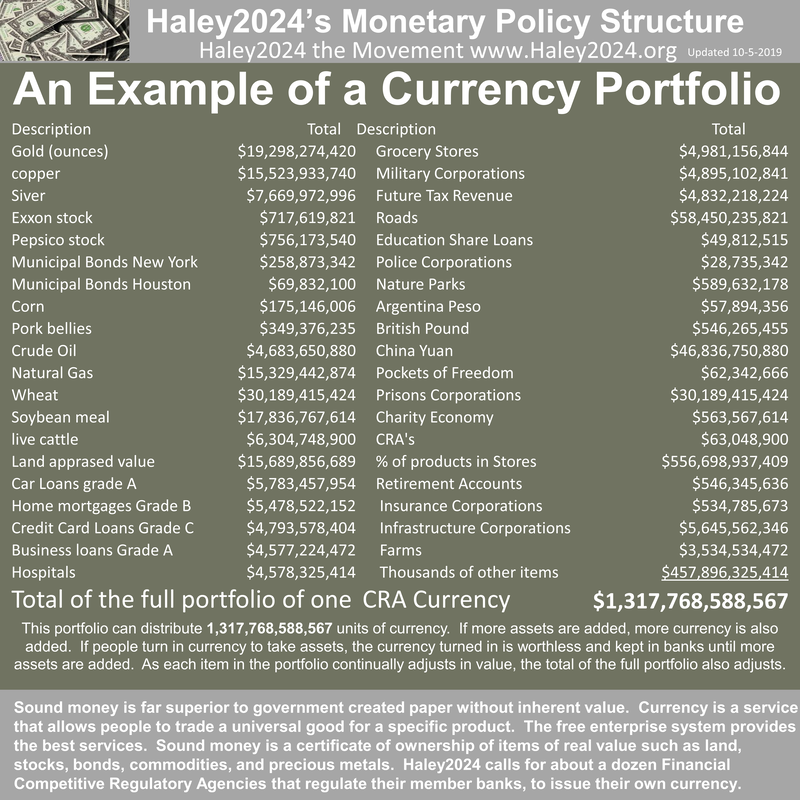

| Sound money is far superior to government-created paper without inherent value. Currency is a service that allows people to trade a universal good for a specific product. The free enterprise system provides the best services. Sound money is a certificate of ownership of items of real value such as land, stocks, bonds, commodities, and precious metals. Haley2024 calls for about a dozen Financial Competitive Regulatory Agencies that regulate their member banks to issue their own currency. |

| Having competition of roughly a dozen ‘central-banks’ means losing monopoly control. The competition will quickly show healthy and inferior results. As assets gain or lose value, it will promptly be realized within the value of money. CRA Asset Portfolios making bad decisions will lose units of currency, and those making wise decisions would gain units. Just like everywhere else within the free market, poorly run businesses lose their ability to control labor hours. Yielding those labor hours to better-run companies. |

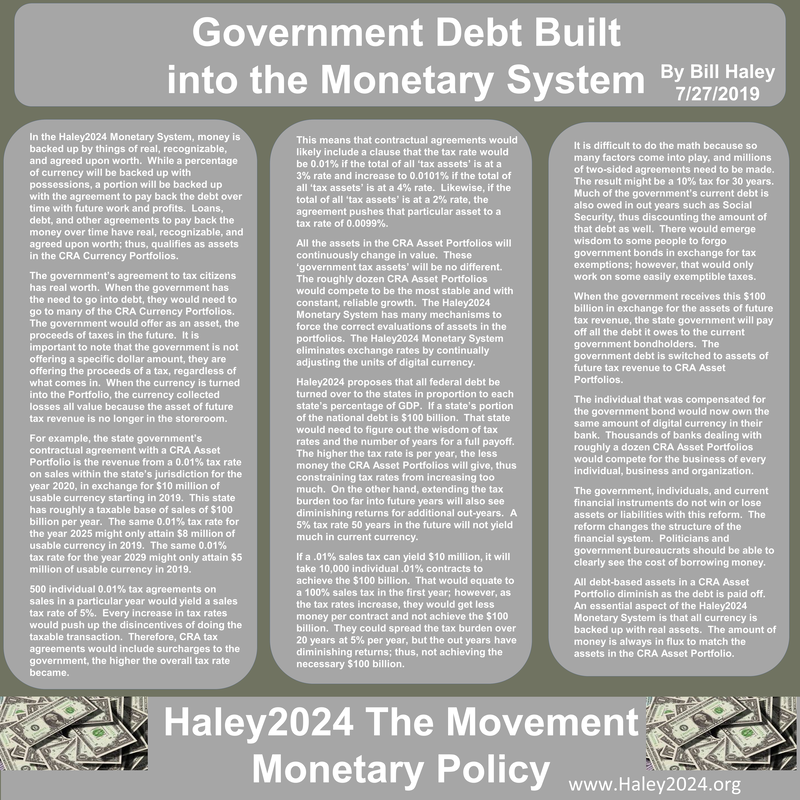

| All deficit spending needs to be tied directly to a future detailed tax. That tax creates worth, thus an asset within a currency portfolio. Most terms on those tax contracts will specify a higher tax rate when the overall tax rate is increased to compensate for the Laffer Curve effects. This will restrain excess spending paid for with tomorrows money. |

| Currency is a service from free enterprise’s invisible hand keeping a ledger that facilitates one-sided provision, yet two-party trades at different times, at different values, and the services provided going to and from the universe of all traders in proportion to each person’s provision. Interest rates are the price of the use of capital over time. Prices are always the best method of distributing goods, thus the best way to allocate capital. |

| The role of prices is highly valuable to achieve the proper levels of goods and services. Prices are also the best way to allocate products and services. Anti ‘price gouging’ laws do significant damage. People truly need to learn the benefits of increased prices in crisis times, so attitudes and opinions can allow prices to work. The hostility to increased prices does real harm in allowing additional supplies and services to enter the marketplace. |

| There are hundreds of price controls within the current government and the Federal Reserve. These price controls, which include price distortions from mandates, bans, government spending, taxes, and favorable or unfavorable treatment of select people/businesses and sectors of the economy, do significant damage to the benefits of the role of prices. |

To Those with Financial Hard Times

| The first line of help will be your rainy-day funds and the insurance you bought, such as unemployment and medical, which is now private. Your Charity Economy would be high on the list. Terms of unemployment insurance are likely to include rapid entrance to the Charity Economy. You could sell a percentage of your income, or a straight dollar figure, for the next several years to a Monetary Asset Portfolio in exchange for currency right now (personal loan). |

Some Basic Ideas

| The 3.5 million schoolteachers in America have a four-year bachelor’s degree. Each one of them should have a semester of nursing school within their education degree. This would come in handy in ordinary times within the classroom. However, in a pandemic, when health care needs overwhelm the 3.1 million RN’s, these teachers can be repurposed into health care. To keep skills current and refreshed, these teachers could have ongoing healthcare education, assist at hospitals, doctor’s offices, and home health in the summer months. |

| To handle the spike in demand situations, many professions could cross-train. For an increase in security spikes and to give year-round security in schools, many teachers should go through the police academy. They could do police shifts in the summer months to keep their training up. Many more cross-training opportunities are available. |

| Every school has classrooms that could double as hospital rooms. Other suitable rooms within businesses should be considered. Nursing homes are already set up similar to hospital rooms. Plans should be made to bring in needed supplies, machines, and personnel, so hospitals are not overwhelmed. Telemedicine would increase capabilities. |

| The elderly have more significant vulnerabilities to illnesses. Teenagers should set up and maintain the elderly with video-chat with many apps. The elderly have experience and wisdom in many professions. With many people repurposed in their jobs, the elderly could watch over, mentor, direct, and educate repurposed labor. The elderly need companionship and a sense they are needed. |

| Businesses with established teams of managers and employees that must shut down because of a loss of business should be given new suitable tasks. Planning well ahead of time would be useful. Health care industries should have a Rating Floor on having excess supplies to handle spikes in demand. This includes many of the current out of stock issues such as sanitizers, medical equipment, and personal protective equipment. |