| There are two significant elements of this type of tax. First, the government, through the Federal Reserve, needs to create new dollars that are not derived from worth. Second, the government needs to give out those dollars without attaining government services. While these two elements were around in the past, in 2020, they have jumped from under 1% to over 20% of GDP. Typical government taxes and spending programs act like society forcing people to purchase public-good items through government control. Taxing yields money earned by individuals providing worth. Those funds benefit all citizens. |

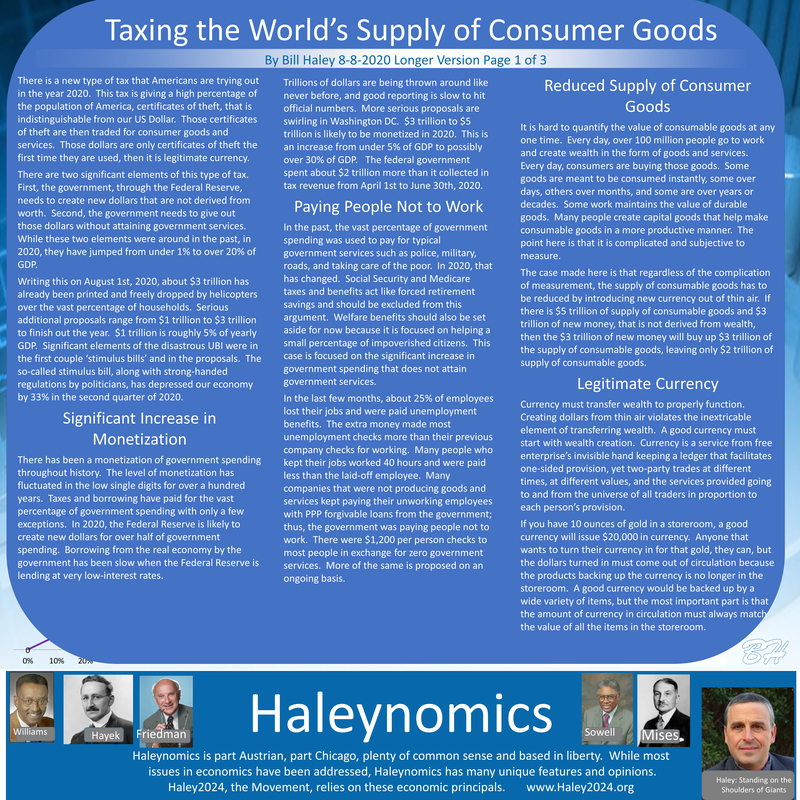

Significant Increase in Monetization

| The level of monetization has fluctuated in the low single digits for over a hundred years. Taxes and borrowing have paid for the vast percentage of government spending with only a few exceptions. In 2020, the Federal Reserve is likely to create new dollars for well over half of government spending. The increase in money used for loans is not included here because the real worth of houses, cars, and capital goods are adding real value to the economy. |

| Trillions of dollars are being thrown around like never before, and proper reporting is slow to hit official numbers. More serious proposals are swirling in Washington DC. $3 trillion to $5 trillion is likely to be monetized in 2020. This is an increase from under 5% of GDP to possibly over 30% of GDP. The federal government spent about $2 trillion more than it collected in tax revenue from April 1st to June 30th, 2020. There is not any expectation, plan, or ability to pull these dollars back out of the system or tax the American people with the tax code, to reverse these actions. |

Paying People Not to Work

| In the past, the vast percentage of government spending was used to pay for typical government services such as police, military, roads, and taking care of the poor. In 2020, that has changed. Social Security and Medicare taxes and benefits act like forced retirement savings and should be excluded from this argument. Welfare benefits should also be set aside for now because it is focused on helping a small percentage of impoverished citizens. This case is focused on the significant increase in government spending that does not attain government services. |

| In the last few months, about 25% of employees lost their jobs and were paid unemployment benefits. The stimulus bill gave extra money to make most unemployment checks more than their previous company checks for working. Many people who kept their jobs worked 40 hours and were paid less than the laid-off employee. Many companies paid their unworking employees with PPP forgivable loans from the government; thus, the government was paying people not to work. There were $1,200 per person checks to most people in exchange for zero government services. More of the same is proposed on an ongoing basis. |

Reduced Supply of Consumer Goods

| Currency must transfer wealth to properly function. Creating dollars from thin air violates the integral element of transferring wealth. Sound money must start with wealth creation. When these new dollars enter the market without providing worth into the market, they just pull products off the shelves. There is X trillion dollars’ worth of consumable goods. $3 trillion of new money will buy $3 trillion of the supply of consumable products, leaving $3 trillion fewer holdings. |

| New money is only certificates of theft the first time they enter the market. After that, the dollar trades wealth for wealth, meaning someone must add products and services into the system before they can take items off the shelves. The new US Dollars can buy products off almost any shelf in the world. The loss in value of the reduced consumer goods stock is spread across the world economy by the inflation tax. |

Creating a Demand?

| Many people will make the point that this extra money from thin air will create a demand and will yield more employment. If there was a three-man economy and two of the men made products and sold what they made, and the third man just created new money from thin air, would it be just? The third man could claim that his new money was creating employment for the other two. Two men produced six products each, and all three men took home four products. The two producers of the products are not happy that the third man gave them more work to do without adding products to the economy. |

The Effects

| Writing this on August 8th, 2020, roughly $3 trillion has already been printed and freely dropped by helicopters over the vast percentage of households. Serious additional proposals range from $1 trillion to $3 trillion to finish out the year. $1 trillion is roughly 20% of quarterly GDP and represents approximately $9,000 per US household. The so-called stimulus bill, along with strong-handed regulations by politicians, has depressed our economy by 33% in the second quarter of 2020. |

| America has lost one-third of its economy, as demonstrated by the second quarter GDP plunge of 33%. Certainly, oppressive government regulations are part of the issue; however, creating new dollars and paying people not to work at a pace of over a third of GDP is a tremendous suppression of our economy. |

| Often, devaluation is hidden for a time. The realization of the depreciation can suddenly appear. Indeed, the losses were slowly accumulating for years, but the recognition of the reduced worth is sudden. Is the Federal Reserve open about their books? There has been a significant ‘audit the Fed’ push since the 2008 great recession that has not happened. This current crisis is about 5 months old, and many official numbers are only revealed months and sometimes years later. The economy is very cloudy when the Federal Reserve allowed $500 billion in loans to big banks to be turned into about $4 trillion of mortgages, car loans, among other real investments. |

| How much worth do people think they own in their investments that are also owned by others? How much wealth is strictly paper without inherent value? Recently, Bernie Madoff and 100 years ago, Charles Ponzi, hid the devaluation of their investments to keep the new money coming in. They paid out large profits to old investors from the new money coming in. The investments appeared amazing until the devaluation was exposed. The Federal Reserve uses its monopoly power over money, with laws requiring acceptance of the US Dollar to do business in America. Ponzi and Madoff never had that monopoly power. |